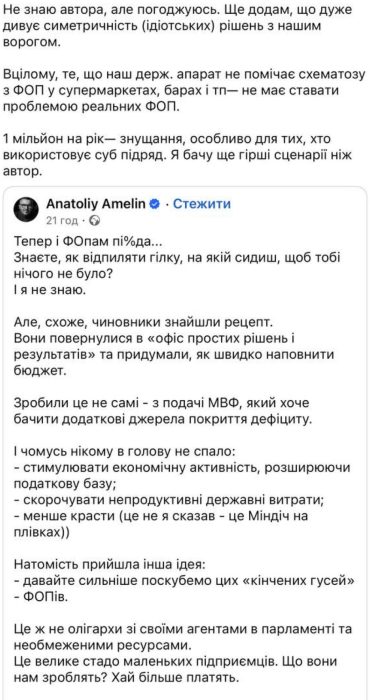

According to Bloomberg, the government is considering introducing VAT for sole proprietors (FOPs) with an annual declared income above 1 million UAH. This would mean a threefold increase in the tax burden for FOPs earning from $2,000 per month. Due to these potential changes, many Ukrainian FOPs who provide remote services (IT, marketing, freelancing, consulting, web design) are already exploring alternatives to the FOP model for their businesses.

Similar discussions are already circulating within the IT community on industry platforms and across Threads and other social media. A potential increase in the tax burden on FOPs could be catastrophic for the Ukrainian tech sector.

One of the most common requests our team has received lately is assistance with setting up a business specifically in Estonia in 2026, which is considered the easiest jurisdiction to start in during 2025–2026. Establishing a legal entity in Estonia is often the first step for Ukrainian businesses that need to operate internationally or simply work with foreign clients. This step has long helped Ukrainians attract new customers and retain existing ones who prefer to avoid the risks associated with making payments to Ukraine during the war. Therefore, an Estonian company has become a viable alternative to the FOP model.

In this article, we will compare the Ukrainian FOP structure with an Estonian legal entity. We will examine the most up-to-date information available as of today, without taking potential future changes into account.

Comparison of taxation: Ukrainian FOP vs. Estonian Company

A third-group FOP under the simplified taxation system, which is not a VAT payer, currently pays a 5% single tax, a 1% military levy, and a 22% unified social contribution.

A legal entity in Estonia does not pay corporate income tax until dividends are distributed to the company’s owners. When dividends are paid, a 22% tax on distributed profits is withheld.

However, it is important to note that the 22% tax is included in the distributed profit. In other words, the effective tax rate in Estonia is approximately 28.21%.

Suppose the company's owner is a tax resident of Ukraine and plans to withdraw dividends. In that case, they will be required to declare the dividends received and pay Ukrainian taxes on dividends from foreign companies, which is a 9% dividend tax plus a 5% military levy.

In summary, the owner of an Estonian company pays a higher tax when receiving dividends; however, if there is no profit, or if profits are retained in accounts or reinvested, tax obligations can be deferred for a long period.

This is especially advantageous for startups testing new projects. Additionally, in the case of an FOP with a large number of contractors, it is important to note that expenses do not reduce the tax burden for entrepreneurs under the single tax system.

It is also important to consider that an FOP is liable with personal assets, whereas an Estonian LLC is liable only within the framework of its share capital, which can be as low as €0.01. €0,01.

Comparison of ease of business registration: Estonia vs. Ukrainian FOP

Process of registering a company in Estonia in terms of ease can be compared to opening an FOP in Ukraine. We have already described the options available to Ukrainians. In short, with an e-Residency card, the registration process takes 1–2 days, and everything can be done remotely without leaving Ukraine.

Like an FOP in Ukraine, an Estonian company must have a registered address. This requirement can be fulfilled through virtual office services, which provide a legal address and handle correspondence on your behalf.

An important point is that all Ukrainian residents are obliged to notify the Ukrainian tax authorities about the establishment of a company in a foreign jurisdiction.

Comparison of accounting and reporting: Ukrainian FOP vs. Estonian OU (LLC)

Although FOPs under the simplified system can handle their own reporting, most entrepreneurs use outsourced accounting services. On average, the cost of such accounting support is around UAH 1,500.

The requirements for financial reporting of an Estonian company are higher than for an FOP but are not complicated. Overall, Estonia is a European leader in accessibility of government services and digitalization. With an accountant, the business is only required to keep and submit all invoices and account statements monthly.

An Estonian accountant, authorized through e-Residency services to submit reports, will prepare and file everything independently, without involvement from the entrepreneur. The cost of such a service depends on the business turnover; for a more detailed calculation, we recommend checking our service offerings in the “Services” section.

For comparison, it is important to note that Estonian companies do not submit reports monthly or quarterly as FOPs do. Companies in Estonia report once a year, by July 1, for the previous year. Only a VAT-registered company is obliged to submit monthly declarations.

The reporting format is straightforward to understand. This is an additional advantage.

that a startup that has not reached the threshold for VAT registration, which is €40,000, does not submit any reports other than the annual one. This implies that the business may go a year, or even two, without incurring accounting costs.

One of the obligations of a foreign legal entity owner in Ukraine is the preparation and submission of special reports on the activities of Controlled Foreign Companies (CFCs). This is a new and relatively complex form of reporting; FOPs do not have similarly complicated reports, but these tasks can also be handled by specialists from our team.

When receiving payments from clients, an Estonian company, like an FOP, must have an account statement describing the service provided (invoice). Invoices can be in English and do not require mandatory translation into Estonian. A contract is not required for each transaction.

If the company owner is obliged to obtain a VAT number, this does not increase the tax burden but rather allows the business to reclaim VAT paid on service purchases. However, having a VAT number will also require charging VAT on certain transactions with your clients.

Comparison of the process of opening a bank account: Ukrainian FOP vs. Estonian LLC

An FOP can freely open an account at any bank in Ukraine. The downsides of Ukrainian accounts for FOPs include restrictions imposed by the National Bank of Ukraine on foreign payments, requirements for selling foreign currency earnings, and exchange rate costs.

Mandatory requirements for Estonian banks to open a company account include having an office, employees, and contracts within the country. This means that a fully remote business cannot open an account at a traditional bank. Alternatives include EMI/PI payment systems, such as Wise, Revolut, and Payoneer. They help solve operational tasks, and their use is completely legal in Estonia.

We’ve gathered everything that matters in one guide: jurisdictions, taxes, payment systems, and the most common mistakes entrepreneurs face when entering new markets.

International presence and reputation: not in favor of the FOP

Suppose your business has an office, managers, and employees in Ukraine. In that case, when establishing an Estonian LLC and working through it with Ukrainian contractors, it is necessary to consider the possibility of creating a permanent establishment in Ukraine.

For international business, reputation and transparency are essential. The FOP format is not always acceptable to foreign clients, as it is an individual operating in a country at war, which introduces risks regarding the fulfillment of contractual obligations. Having a company in a European jurisdiction is also a positive factor for protecting intellectual property rights and attracting investors to a scaling business.Additionally, a Ukrainian FOP cannot use many modern solutions, such as Stripe, due to restrictions on our country.

Comparison: Ukrainian FOP vs. Estonian OÜ (LLC)

Criterion | FOP (Ukraine) | Estonian LLC (OU) |

Taxation | 5% (or 3% + VAT) + 1% (military levy) + 22% (social contribution) | 0% on retained profits; 22% on distributed profits |

Reporting | Quarterly / Annual; VAT – Monthly | Annual report only; VAT – monthly (if VAT registered) |

Use of Profits | Possible immediately | Dividend distribution required |

Business accounting support | UAH 1,000–2,500/month | €50–150/month; with low activity: annual report only |

Share capital | None | From €0,01; often €2500, but not required to deposit immediately |

Opening a business account | Ukrainian banks | Wise, Revolut, Paysera, banks in other countries |

Stripe/PaPal | Not available | Fully supported |

Reputation with international clients | Medium | High |

Ability to attract investment | None | Full corporate structure |

Liability | Personal, all assets | Limited to share capital |

Inspections | More frequent | Rare; primarily online |

Adress | Personal registration required | Virtual office required |

Risk of permanent establishment in Ukraine | None | Possible if the office/employees in Ukraine |

A comparison of a Ukrainian FOP and an Estonian legal entity shows that each model has its advantages and limitations, and the optimal choice depends on the type of business, its scale, and strategic plans. The FOP remains the simplest and most cost-effective form of business in Ukraine; however, the potential introduction of VAT for entrepreneurs with income exceeding UAH 1 million would significantly increase the tax burden and reduce its current attractiveness.

An Estonian company, on the other hand, offers much broader opportunities for developing an international business, access to global payment solutions, a higher reputation among foreign partners, limited liability, and no corporate income tax until dividends are distributed. For startups and scaling companies, this provides an important advantage in the form of the ability to reinvest funds without additional taxation.

At the same time, establishing an Estonian company requires consideration of specific obligations: submitting reports on controlled foreign companies, compliance with accounting requirements, and evaluating the risks of creating a permanent establishment in Ukraine.

In conclusion, for entrepreneurs focused on the local market with modest turnover, the FOP remains the optimal model. For those planning to work with international clients, expand their team, or attract investment, establishing a company in Estonia becomes a logical and strategically advantageous step.

Even under the worst-case scenarios regarding tax changes, an Estonian company can serve as a viable alternative to a third-group FOP.

Contact our WoBorders team; we will help calculate your business expenses, determine which FOP alternative is best for you, establish an Estonian OÜ, set up accounting and tax support, and prepare all reports for Ukraine with minimal risk.

We operate Monday through Friday, from 9:00 to 19:00. To request a consultation, contact us via the website form, phone, or your preferred messenger.