For a product business, choosing a jurisdiction and registering a SaaS company are not just formalities but strategic business decisions. The jurisdiction determines the tax burden, legal safeguards, speed of scaling, access to investor capital, and the company’s long-term value.

In 2024, over 70% of SaaS startups that raised more than $10 million in investment were registered in the United States, Ireland, or the United Kingdom. This is not a coincidence: these countries have developed judicial systems, stable corporate practices, clear regulations of digital services, and a high level of trust among venture funds and strategic investors.

Choosing a jurisdiction directly affects the development of a company operating under a SaaS model, including integration with Stripe and Paddle, scalability, the path to an IPO, or the ability to raise subsequent investment rounds. Regulations such as GDPR, VAT, or Sales Tax administration, as well as industry requirements, create real legal and operational constraints even before the business launches.

The legal registration of a business shapes its corporate structure, including the holding jurisdiction, the IP ownership model, the tax architecture, and the rules of interaction with investors and payment systems. For a SaaS business, registering a SaaS company at this stage directly determines how investor-friendly this model will be and how compatible it is with payment infrastructure.

- International VAT and digital services taxes

Suppose a company sells services in the EU but is registered outside it. In that case, it is still required to register under the OSS or MOSS system, maintain separate tax accounting, and submit reports for each transaction. This leads to additional costs for accounting and legal support. Registering within an EU country streamlines this process and eliminates the need for multiple VAT registrations in different jurisdictions.

- Merchant of Record (MoR) model

Some jurisdictions allow SaaS-model companies to work with Merchant of Record providers (Paddle, FastSpring), which officially act as the seller to the customer and take on tax and legal obligations. This significantly simplifies VAT, Sales Tax, and compliance administration for customers in multiple countries.

At the same time, access to MoR, Stripe, or other payment solutions depends less on the product itself and more on the company’s corporate structure. Banks and payment providers assess the registration jurisdiction, operational transparency, and the legal model of the business. These factors determine whether the company can pass onboarding and scale payments.

- Investment attractiveness

US venture funds typically invest in product companies registered as a Delaware C-Corp, because this structure provides clear corporate governance, minority shareholder protection, and flexible instruments for issuing shares. European investors more often work with companies registered in Ireland, Estonia, or the Netherlands, where stable regulation, IP protection, and a predictable tax environment are combined.

In practice, investors evaluate not the product, but the business’s corporate structure, including the holding jurisdiction, shareholder rights, the IP ownership model, and corporate governance. These elements determine whether the company is ready to raise capital, scale, or pursue an exit strategy.

- Regulatory restrictions and licensing

For digital companies operating under a SaaS model in fintech or healthcare, it is important to consider local KYC/AML requirements, data security certifications (ISO 27001, SOC 2), and industry standards (HIPAA, PSD2). Failing to account for these rules during the stage of registering a SaaS company may complicate the launch or lead to penalties.

- Operational flexibility and currency controls

Some countries impose restrictions on opening foreign currency accounts, moving capital, or currency conversion. A business with global customers needs the ability to open multi-currency accounts, have legal access to international payment gateways, and execute international transfers quickly without currency barriers.

For SaaS businesses focused on rapid growth, the Double Company model is often used. This corporate structure includes a holding company in a jurisdiction with high investment appeal (United States, United Kingdom, Ireland) and an operating business in a country with simpler administration and a moderate tax burden (Estonia, Cyprus, Poland). This structure allows a SaaS company to combine investment attractiveness with operational efficiency, ensure clear corporate governance, and optimize the tax burden without sacrificing scalability.

In practice, it is the corporate structure of a SaaS business, not the product itself, that determines the speed of scaling, access to investors, and the ability to raise capital.

Criteria for choosing a jurisdiction for SaaS

If a SaaS company plans to enter the EU, US, or Asian markets–or operate globally–it is worth defining the key “search filters.” The legal setup of a company operating under a SaaS model should consider not only taxes, but also legal compatibility with payment systems, investors, and global platforms.

Criterion | What to consider |

Taxes |

|

Administrative simplicity |

|

Banking and payment systems |

|

Jurisdiction reputation |

|

GDPR and other IT regulations |

|

These criteria help assess not only the tax burden, but also the legal compatibility of a SaaS business with payment systems, investors, and global platforms at the registration stage.

Which countries do SaaS leaders choose?

Click on a marker to learn more about the location

Businesses targeting the European or US markets most commonly choose jurisdictions such as the United States, United Kingdom, Cyprus, Estonia, PolandThis addresses the key objective: running a business remotely in a jurisdiction with a strong reputation and access to essential payment processing tools.

Without access to Stripe or Paddle, a SaaS company risks losing 50–70% of potential customers due to distrust in alternative payment solutions. In addition, in Poland–even without an office–it is relatively easy to open an account with a traditional bank, which makes it possible to have an account in the country where the business is registered. In all these countries, capital movement is free, which is especially important for companies working with customers worldwide.

Taxation differs across each of the listed countries. The United States can certainly be considered the most complex in this regard, while Estonia is the simplest. However, it is important to understand that European businesses find it easier to obtain an EU VAT number and administer VAT. If your primary market is Europe, an EU business will be more familiar to your customers and will be perceived by default as operating under GDPR rules.

If a SaaS company plans to raise investment or prepare for M&A or an exit, the United States is the best fit for these objectives. However, European countries also have a strong reputation among investors.

Jurisdiction comparison: the table of contents shows how different countries affect a SaaS company’s corporate structure, access to Stripe and Paddle, tax burden, and investment attractiveness.

We’ve gathered everything that matters in one guide: jurisdictions, taxes, payment systems, and the most common mistakes entrepreneurs face when entering new markets.

Country/Region | Remote management | Taxes | Stripe/Paddle |

United States | yes | 21% (C-corp) | yes |

UK | yes | 25% | yes |

Estonia | yes | 0% (22% on distributed profits) | yes |

Poland | yes | 9% (up to €2M) | yes |

Cyprus | yes | 12,5% | yes |

Country/Region | Pros | Cons |

United States | Investment attractiveness | Complex accounting, high tax burden |

UK | Stability and strong reputation | High corporate tax |

Estonia | Convenience and speed, simple accounting | Less popular among investors |

Poland | Possibility to open a traditional bank account | More complex administration |

Cyprus | Low corporate tax, no dividend tax | Audit required, local director needed |

Additionally, SaaS companies often opt to register in Ireland, the UAE, Hong Kong , or other countries. Each of these jurisdictions has its own advantages and disadvantages.

Our team will be happy to consult you in detail on each option. In any case, we recommend starting with a clear understanding of the SaaS business objectives, its corporate structure, and target markets. Furthermore, check whether all the required services are available in the chosen jurisdiction.

Marketing and Go-to-Market are the next stage of SaaS growth

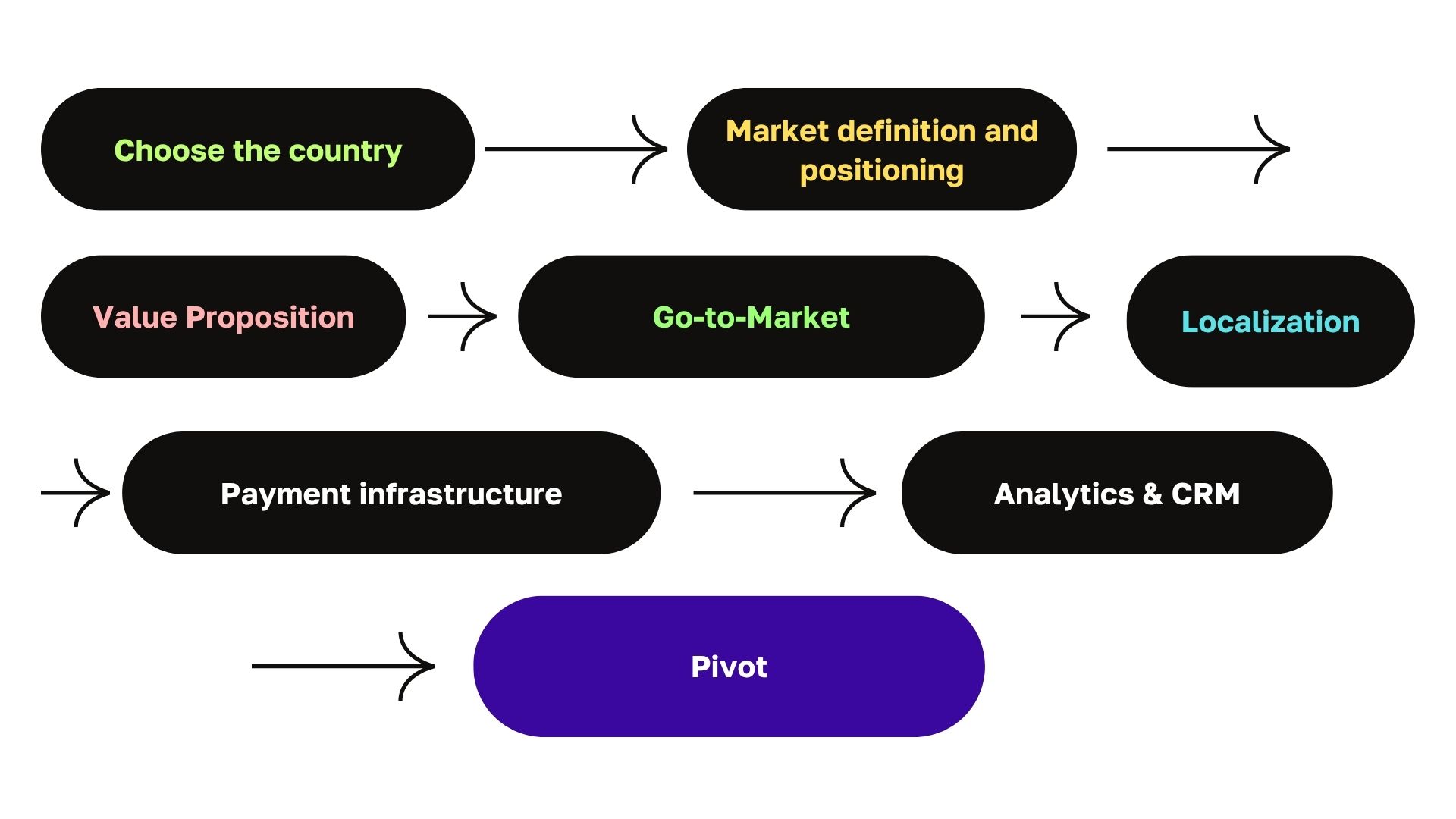

Choosing a country for SaaS company registration is the foundation for further scaling, marketing, and sales. The legal structure and tax conditions create the starting platform for the business, and a well-built marketing strategy turns it into a scaling instrument.

The first step is always defining the market and positioning. For a SaaS product to establish itself quickly in the chosen segment, you need to clearly define the Ideal Customer Profile and buyer personas: understand who your customer is, what problems they want to solve, and why they will choose you over alternatives. This is not just a user description–it is the foundation for all further communication and sales.

Next comes the value proposition: is formed–a message that resonates with the audience and clearly reflects the product’s competitive advantage. This is not only a marketing slogan, but also an argument for investors, partners, and early customers.

Once positioning and UVP are defined, it is time to choose go-to-market channels. There is no universal formula: for some products, launches on Product Hunt or AppSumo will work; for others, active presence in LinkedIn Ads and Google Ads, combined with content marketing and partner programs, will be more effective. The key is to test several options early to understand where the response is strongest.

- The next strategic block is localization. A SaaS product operating in multiple markets must “speak” the user’s language and meet cultural and legal expectations. This means translating the interface and website, adapting UX, and updating policies in line with GDPR, CCPA, and industry standards. Localization directly affects conversion, and underestimating it is often a reason for failure in new markets.

- Equally important is setting up payment infrastructure.Stripe, Paddle, Payoneer and MoR solutions allow you to accept international payments without delays or friction for the customer. Tax automation tools like Stripe Tax or Quaderno reduce the administrative burden and minimize the risk of compliance errors.

- In parallel, from day one, you should build a system for analytics and customer management.A CRM such as HubSpot, Odoo, or Pipedrive ensures a transparent lead workflow, while tools like Mixpanel, GA4, or Amplitude help track key metrics, user behavior, and the lifecycle (LTV).

- The final stage before scaling is launching a pilot. These are the first 50–100 users who provide feedback, test pricing plans, and validate or refute hypotheses about behavior and UX. A pilot helps identify weak points and lays the foundation for a scalable acquisition model.

- This sequence – from market definition to a pilot–helps a SaaS company enter the market not just quickly, but with maximum readiness for predictable growth.

- In summary, a well-chosen jurisdiction and registering a SaaS business are the foundation that determines scaling speed, access to payment infrastructure, and readiness for investment.

WoBorders supports SaaS company registration at the launch and scaling stages: from choosing a jurisdiction and building a corporate structure to banking, payment systems, tax modeling, and preparing the business for investment or M&A. We do not work with “one-size-fits-all solutions,” but with a specific SaaS business model, its target markets, and growth plans.

You can contact us via the website form, messengers, or by scheduling a consultation at a convenient time. Working hours: Monday–Friday, 10:00–18:00 (Kyiv time). We work based on the substance of the request–without template solutions and without pushing structures that do not match the SaaS business model.

Useful services for SaaS

Is an international payment platform that allows companies and freelancers to open corporate accounts with their own IBAN, and send and receive payments worldwide. It is used in e-commerce, freelancing, marketplaces, and SaaS businesses for working with customers globally.

A cloud-based service that automates invoicing, tax compliance, and VAT/GST handling for online businesses, including SaaS companies, marketplaces, and digital goods sellers. It calculates and applies the correct tax based on the customer’s location (EU VAT, US sales tax, GST, etc.).

An international payment platform that allows businesses to accept card payments from clients in various countries. Supports Apple Pay, Google Pay, and enables automatic billing setups.

A UK-based platform for payment processing and digital product sales management that acts as a Merchant of Record (MoR). Paddle serves as the official seller to your customer and assumes full legal and tax responsibility for the transaction. You receive funds already net of taxes, without having to register for VAT or other taxes in multiple countries.

A cloud platform for subscription management and billing automation, popular among SaaS businesses and companies with recurring payments. Handles financial and administrative aspects such as invoicing, subscription billing, plan changes, seamless upgrades/downgrades, and automation of running processes (reminders, retries, etc.).